Family Law Disclosure Extends Beyond Corporate Financial Statements

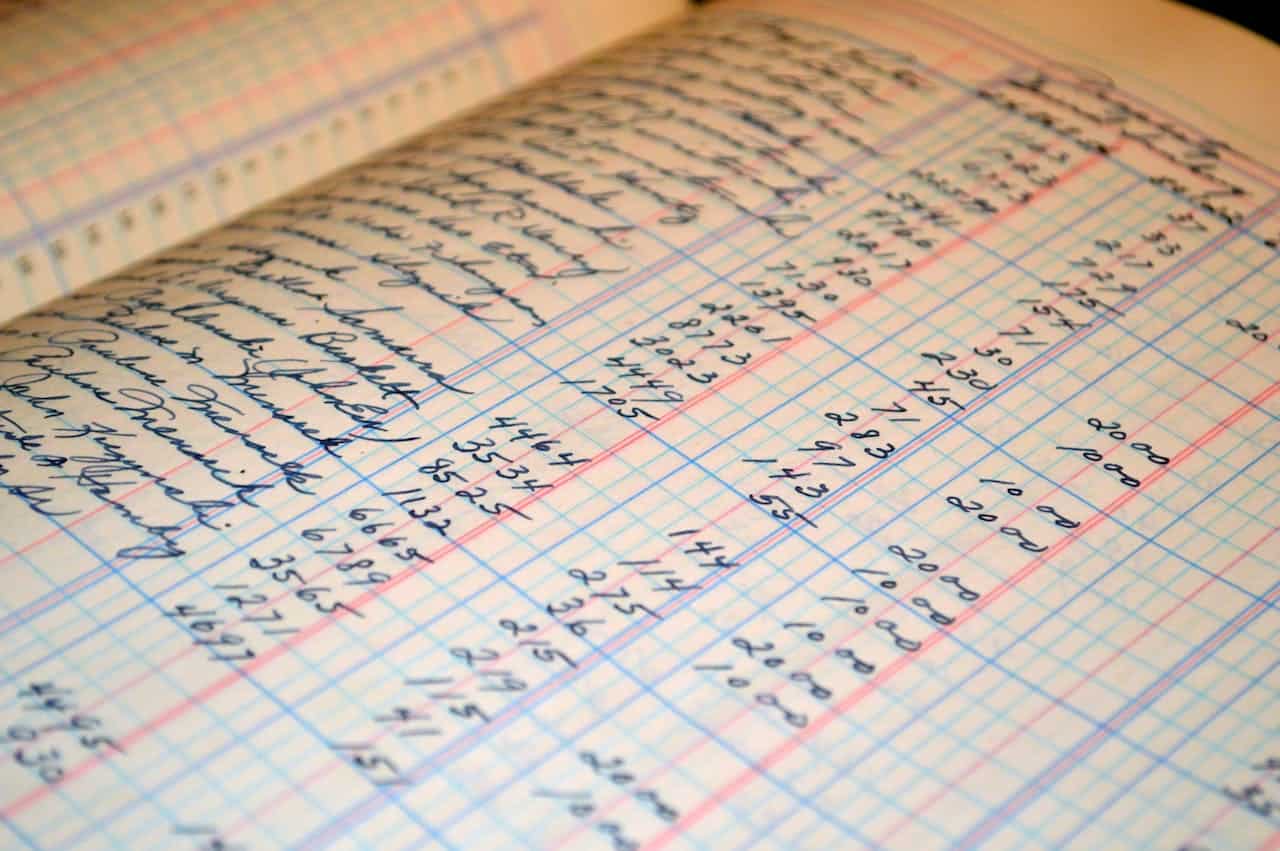

Getting a divorce is often a very stressful experience. It can become even more stressful if parties need clarification on their obligations, which includes a significant duty to provide full and accurate disclosure in their family law proceeding. Disclosure requirements can be extensive, and it is important for parties to understand what is expected of them fully. Otherwise, there can be negative consequences that arise from non-disclosure, which can be very costly. When one or more parties run a corporation, disclosure requirements can be complex. Additional information beyond corporate financial statements and tax returns may be required, including explanations for certain corporate activities.

In this post, we will discuss a party’s disclosure requirements in a family law proceeding. Several key points will be addressed on disclosure requirements when a corporation is a major source of income for one or more parties. We will also examine a case example, Rolinger v. Rolinger, 2021 ABQB 474, in which the court found that the husband, whose main income source was from his corporation, was required to provide explanations for some of his corporate activities, as it appeared that not all of his income was reported on the company’s financial statements and tax returns. This post will provide important takeaways regarding disclosure requirements for parties involved in a family law proceeding in which a corporation is one of the party’s primary sources of income.

Disclosure requirements in a family law proceeding

There is a significant duty for parties to provide full and accurate disclosure in a family law proceeding. The court does not take this obligation lightly and will impose negative consequences on a party without fully and accurately disclosing their income and property. Therefore, it is important for parties to have a clear understanding of what is required of them with respect to disclosure.

According to s. 7.4 of the Divorce Act, parties must provide complete, accurate, and up-to-date information for their family law proceeding. Each party must take active steps to provide ongoing disclosure, as it must be up-to-date and provide the full picture. As we will see in the case below, further disclosure may be required if the existing disclosure does not provide a complete understanding of the financial information required to determine support or property division.

Additionally, under s. 65(1) of the Alberta Family Law Act, parties can request further financial information from each other for determining support. Each party must provide the requested information to fulfill their duty to provide complete disclosure. If a party fails to respond to the request adequately, the court can make orders to address non-disclosure. These types of court orders under the Family Law Act can escalate in severity if a party fails to provide full and accurate disclosure. For instance, the court can issue contempt orders, draw adverse inferences against the non-disclosing party, deny their application, and award costs in favour of the other party.

Section 19(1) of the Federal Child Support Guidelines also requires a party to provide complete disclosure throughout to determine child support.

Disclosure of property required by Alberta Family Property Act

Besides financial information, parties are also required to disclose all property that they own. Section 31 of the Alberta Family Property Act states that parties must provide a sworn statement of all the property they own, including property located outside of Alberta.

What types of disclosure documents are you required to provide?

To fulfill your disclosure obligations, parties must provide documents to support their sworn financial statement. This includes income tax returns, notices of assessments, recent pay stubs, and statements to prove all of your income sources. Parties should provide their bank account, investment, credit card, line of credit, and RRSP statements. Other required supporting documents include property appraisals and pension valuations.

If a party owns a business, financial documents regarding the company are also required. This can include corporate financial statements and tax returns. Further disclosure is often required when a party has an interest in a business, and the business provides a primary income source. The case below illustrates some examples of further required disclosure when a corporation is involved.

Disclosure requirements can include corporate reconciliations

In the Rolinger case, the husband’s income was at issue. The husband and his brother equally owned four business corporations, the husband’s primary sources of income.

As the husband’s income was primarily from the corporations, he retained an accountant to produce an expert Guideline income report, which was available before the court. The wife claimed that the husband did not provide proper disclosure, so the conclusions of the Guideline income report should not be relied upon. She claimed that the husband did not disclose adequately to the expert or her.

The wife claimed that the corporate bank deposits were significantly higher than reported revenues. The court found that while it is not necessary to complete an audit on the company’s financial statements, a further reconciliation may be warranted in this case, as there was a significant difference between the deposits and reported revenues, despite recognizing that it is not required for the amounts to be equal.

Also, while the expert made amortization adjustments on the husband’s income from personally owned rental properties, the expert did not do so on the corporate front and did not explain. In this case, three of the corporations had significant amortization expenses.

The court found that the husband’s income, as set out in the report, needed to be adjusted, as further information was required. In particular, the court sought further information on the company’s reconciliations, including comparisons of the corporate bank deposits versus the reported revenues listed on the corporate financial statements and tax returns. The court also ordered that the husband provide further information explaining why no amortization adjustments were made on the corporate front in the report.

Key takeaways

Parties must provide full and accurate disclosure. When a corporation is a source of income for one or more parties, further information beyond corporate financial statements and tax returns may be necessary to fulfill one’s disclosure obligations.

Calgary Family Lawyers Assisting You With Your Disclosure Obligations

Parties to a family law proceeding must make full and accurate ongoing disclosure. There can be significant consequences for failing to comply with disclosure obligations, so it is important to understand them from the outset. If you are seeking outstanding financial disclosure or require assistance with your disclosure obligations, you should speak with one of our family law lawyers at Mincher Koeman, who are experienced in assisting business professionals and entrepreneurs with disclosure issues in family law proceedings. Our experienced family law lawyers are dedicated to finding the best resolution after your divorce.

To book a consultation, please contact us online or by phone at 403-910-3000.

A team above all. Above all a team.

Calgary Office

707 7 Ave SW #1300,

Calgary, AB T2P 3H6

Canmore Office

621 10 St #101

Canmore, AB T1W 2A2

Subscribe to our blog!

© Mincher Koeman LLP 2025. All rights reserved.

Website designed and managed by Umbrella Legal Marketing